Allocate Overhead Cost Formula

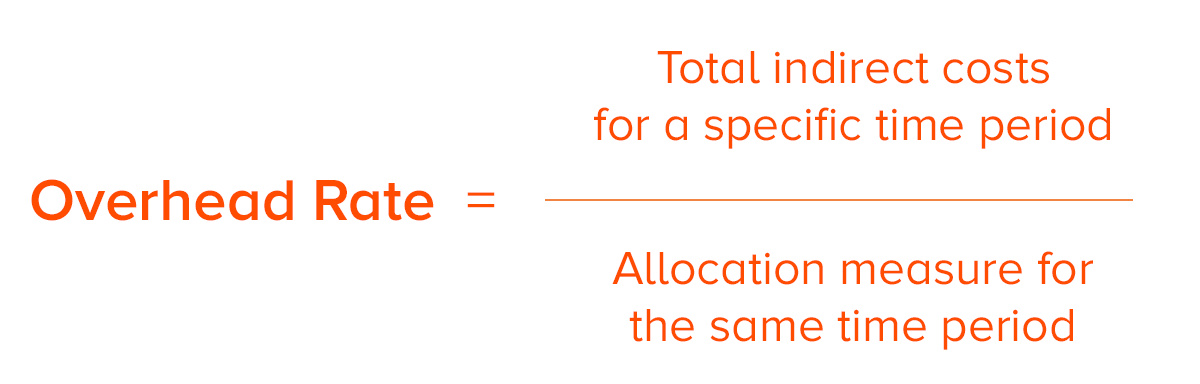

It is only upon determining the overhead rate that the overhead costs can be allocated to individual cost drivers. This is called the overhead allocation rate.

How To Calculate Restaurant Overhead Rate On The Line Toast Pos

To allocate manufacturing overhead costs the formula is O A.

. By selecting the formula to allocate overhead OH costs. Therefore the calculation of manufacturing. For example if your company has 80000 in monthly.

After learning how to conduct cost-volume-profit analyses were ready to discuss cost allocation and the different types of systems we can use. Firstly determine the cost of goods sold which includes all direct and indirect costs of. And to get the overhead rate.

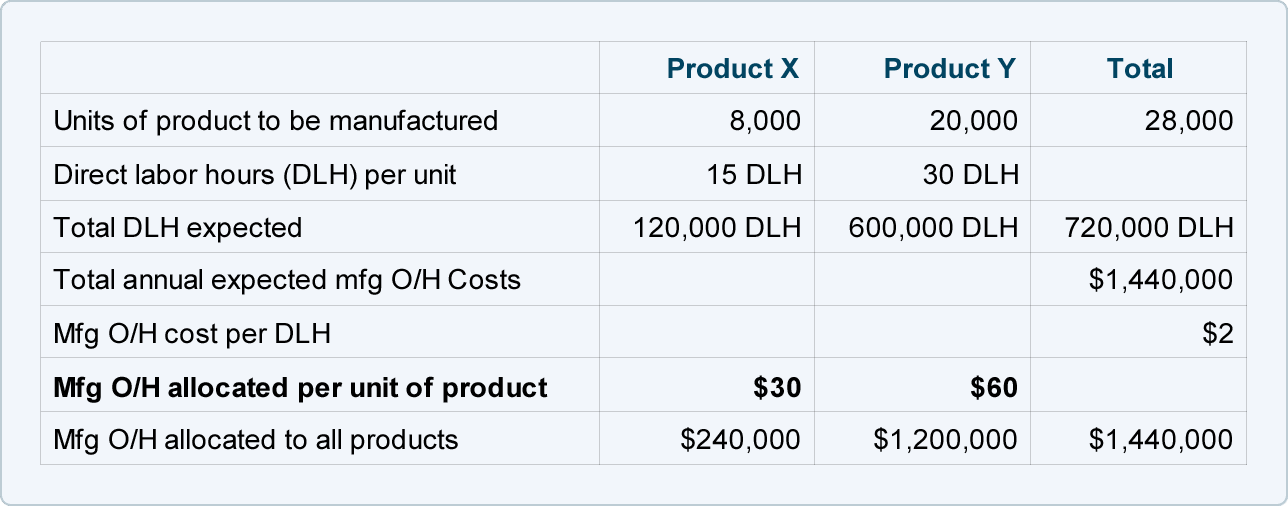

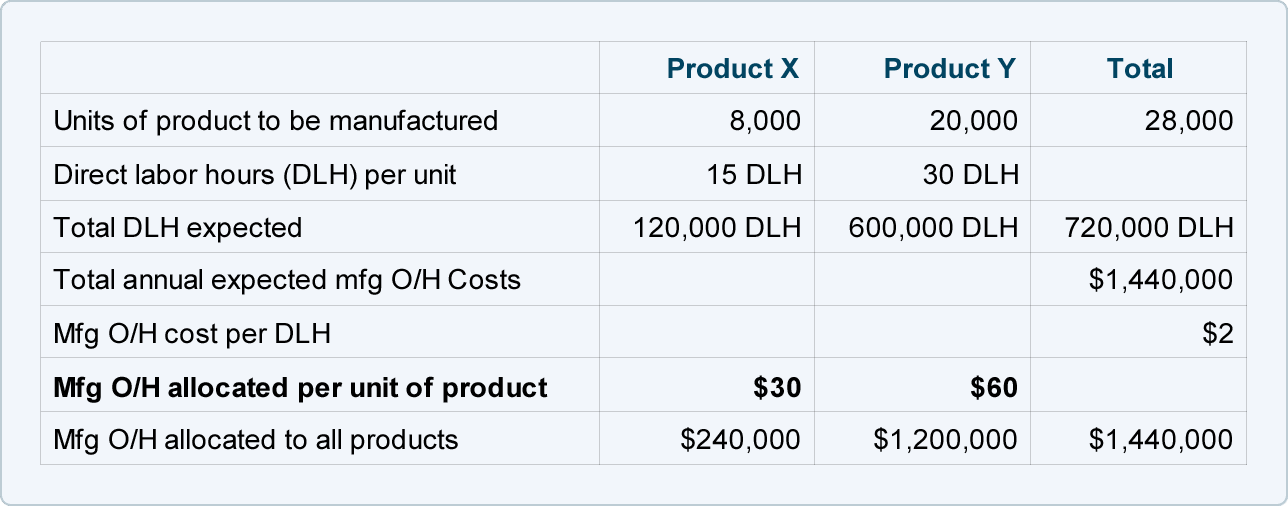

This is the monthly percentage you must pay for overheads. Thus as shown in Figure 31 Using One Plantwide Rate to Allocate SailRite. Some expenses provide benefit to multiple activities so they should be allocated to more than.

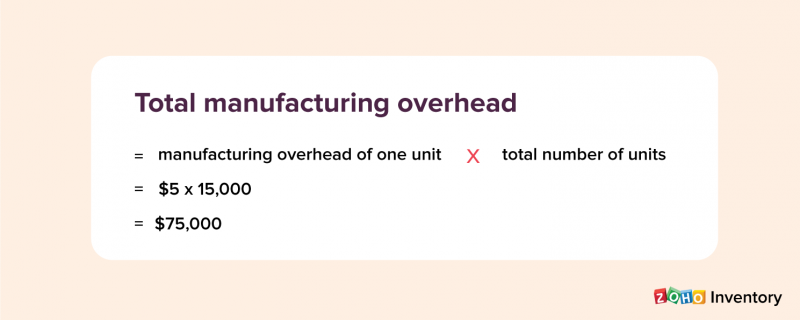

To compute the overhead rate divide your monthly overhead costs by your total monthly sales and multiply it by 100. The Allocation class is a part 1 of 2 phase of preparing the financial statements. For example if materials for a single product cost 1 they are treated.

In this case divide your monthly overhead costs by your total monthly sales. The formula is as follows. Overhead Costs 8000 6000 4000 1000 1000.

The typical procedure for allocating overhead is to accumulate all manufacturing overhead costs into one or more cost pools and to then use an activity measure to apportion. Each tire has direct costs steel belts tread. The standard overhead cost formula is.

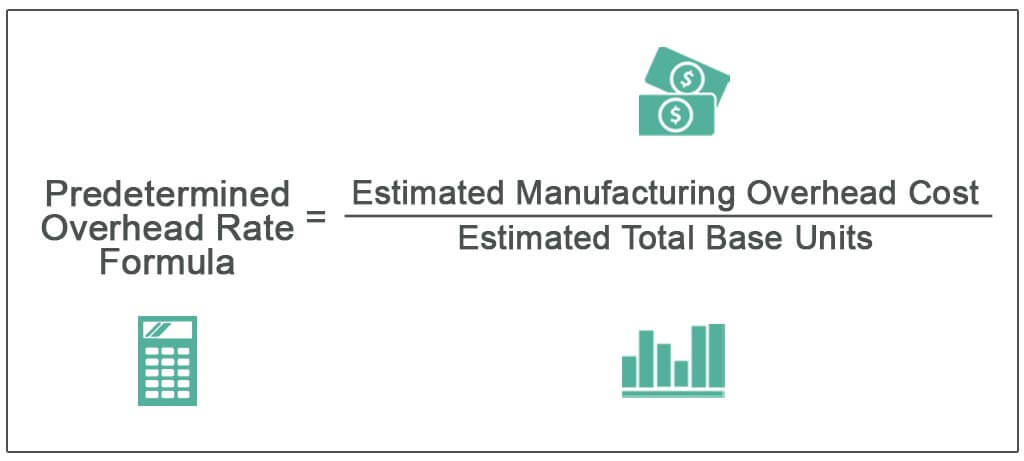

So if your total overhead cost per product is 50 and an employee works two hours to manufacture one such unit the allocated manufacturing overhead would be. When setting costs and making budgets you should know the percentage of funds dedicated to overheads. The predetermined overhead rate is 32 per direct labor hour 8000000 250000 direct labor hours.

To calculate the overhead costs compared to sales divide the. Predetermined OH allocation rate Actual aty of the allocation base used Allocated. Accounting questions and answers.

The formula for manufacturing overhead can be derived by using the following steps. Predetermined overhead allocation rate x Actual quantity of the allocation base used OB. Fixed overhead cost per unit 5 hours per tire x 6 cost allocation rate per machine hour Fixed overhead cost per unit 3.

The below percentage was based on gross revenue and gross revenue for that period was 456789300. In that case the monthly overhead costs are divided by the monthly labor costs and multiplied by 100. Indirect Cost Activity Driver Overhead Rate Lets say your business had 850000 in overhead costs for 2019 with direct.

As a standalone metric the 20k in overhead is not too useful which is the reason our next step is to divide it by the.

Traditional Methods Of Allocating Manufacturing Overhead Accountingcoach

Indirect Cost Calculation And Process About Ala

No comments for "Allocate Overhead Cost Formula"

Post a Comment